Professional Service Providers(PSPs)

Proposed reforms include regulating Professional Service Providers (PSPs) in Australia, implementing a key recommendation from the Report of the Statutory Review (published in Apr 2016) of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 and the Associated Rules and Regulations that relate to PSPs.

https://www.ag.gov.au/consultations/pages/StatReviewAntiMoneyLaunderingCounterTerrorismFinActCth2006.aspx

Recommendation 4.6 in the report suggests to:

a) develop options for regulating lawyers, conveyancers, accountants, high-value dealers, real estate agents and trust and company service providers under the AML/CTF Act, and

b) conduct a cost-benefit analysis of the regulatory options for regulating lawyers, accountants, high-value dealers, real estate agents and trust and company service providers under the AML/CTF Act.

PSP is a collective term used by the department to describe legal practitioners, accountants,consultants, trust and company service providers, financial advisors and business brokers.

Australia’s PSPs are diverse, with businesses that vary substantially in the breadth and nature of services they provide, the clients they serve and the size and level of sophistication of the business and its employees.

Financial Action Task Force (FATF) Report

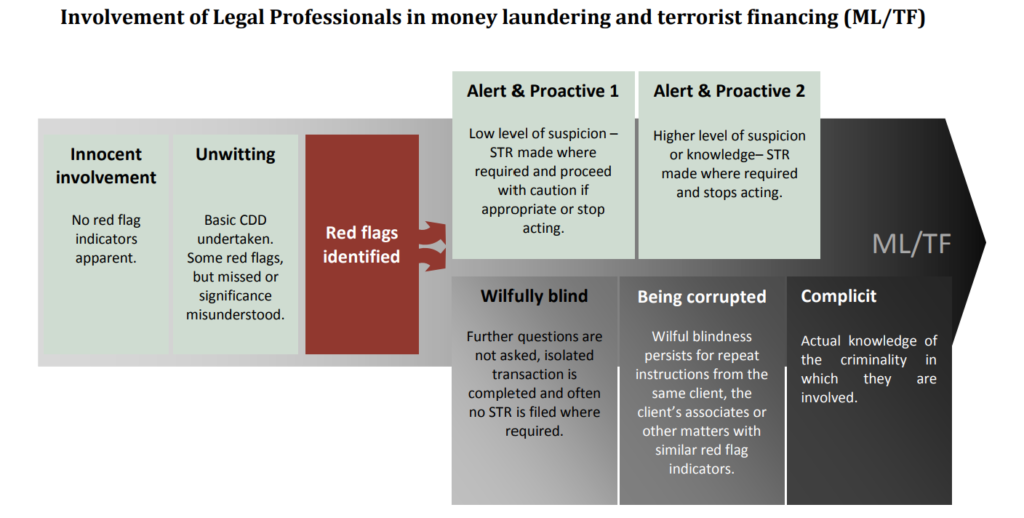

The inter-government body that sets international standards for combating ML/TF, the Financial Action Task Force (FATF), released a report in 2013 that considered legal practitioners to be vulnerable to ML/TF because they handle a large number of financial and related transactions. After reviewing international case studies and literature, the FATF assessed that the involvement of legal practitioners in money laundering could not be described simply as either “complicit” or “unwitting”, but tended to follow a continuum from ‘innocent involvement’ to ‘complicit’

ML & TF Vulnerabilities

The World Economic Forum identified the use of professional facilitators as one of two key enablers of money laundering, alongside the related activity of concealing beneficial ownership through complex corporate and trust structures for the purpose of illicit financial transactions. PSPs present following vulnerabilities –

- conceal proceeds of crime

- obscure ultimate ownership through complex layers and legal entity structures

-

evade and exploit known tax shelters

-

evade regulatory controls, including Australia’s AML/CTF regime

-

provide a veneer of legitimacy to criminal activity

-

create distance between criminal entities and their illicit income or wealth by using complex business and corporate structures

-

avoid detection and confiscation of assets, and

-

hinder law enforcement investigations

- obscure ultimate ownership through complex layers and legal entity structures

Accountants

The Australian Auditing and Accounting Public Policy Committee (APPC), established in 2009, is as a key policy vehicle for the Australian accounting profession. The APPC includes BDO, CPA Australia, Deloitte, Ernst & Young, Grant

Thornton, KPMG, PKF, PwC, The Institute of Chartered Accountants in Australia and the

Institute of Public Accountants.

The APPC’s objective is to promote positive public policy outcomes in respect of audit,

accounting and related services in Australia that:

1. Enhance the reputation of the accounting profession by setting and adhering to high

standards of ethical and professional conduct.

2. Preserve the viability of a high quality, independent, external financial audit

profession through an ongoing focus on audit quality and fair and equitable

apportionment of the financial risks associated with the audit function.

3. Add value to the accounting profession’s clients and stakeholders.

In its submission to the Government’s statutory review of the AML/CTF regime, the APPC’s Anti-Money Laundering Tranche 2 Working Group expressed its in-principle support of the extension of the existing AML/CTF regime to DNFBPs, as envisaged under the FATF recommendations, subject to genuine and thorough consultation with stakeholders.

- Chartered Accountants Australia and New Zealand (Chartered Accountants Australia & New Zealand | CA ANZ (charteredaccountantsanz.com)

- CPA Australia (Home | CPA Australia)

- Institute of Public Accountants (Institute of Public Accountants)

These three bodies have also established the Accounting Professional and Ethical Standards Board (APESB –Home – APESB)

Note – It’s not mandatory for a practicing accountant to be a member of the above bodies.

Legal Practitioners and Conveyancers

In 2015, a common framework for legal regulation to standardises practising certificates, billing arrangements, complaint handling processes, professional discipline issues and continuing professional development was implemented. Together, the Legal Services Council and Commissioner for Uniform Legal Services Regulation oversee the Legal Profession Uniform Law scheme – a regulatory framework for Australian legal practitioners. The Uniform Law scheme has applied to legal practitioners in NSW and Victoria since 1 July 2015. Western Australia joined the scheme on 1 July 2022.

Seven different regulatory frameworks continue to operate at the state and territory level to deal with the day-to-day regulation of legal professions. Regulation is currently based on a co-regulatory model, which includes Law Societies and Bar Associations, independent statutory authorities, and the Supreme Courts in each State and Territory.

Independent statutory authorities with regulatory roles include the:

• Legal Services Board and Legal Services Commissioner, Victoria (Home | VLSBC)

• Legal Services Commissioner, New South Wales(Office of the NSW Legal Services Commissioner)

• Legal Services Commission, Queensland (Home – Legal Services Commission (lsc.qld.gov.au))

• Legal Practice Board, Western Australia (LPBWA – Home)

• Legal Practitioners Conduct Board, South Australia (Legal Profession Conduct Commissioner (lpcc.sa.gov.au))

• Legal Practice Board of Tasmania (Legal Profession Board of Tasmania: LPBT)

There are 16 Australian State and Territory Law Societies and Bar Associations some of which perform certain regulatory functions, for example, issuing licences to practice, establishing rules and professional standards, and investigating complaints of professional misconduct and unsatisfactory conduct under delegation. These Law Societies and Bar Associations include the:

• Australian Capital Territory Law Society

• Australian Capital Territory Bar Association

• Law Society of New South Wales

• New South Wales Bar Association

• Law Society Northern Territory

• Northern Territory Bar Association

• Queensland Law Society

• Bar Association of Queensland

• Law Society of South Australia

• South Australian Bar Association

• Tasmanian Independent Bar

• Law Society of Tasmania

• Law Institute of Victoria

• The Victorian Bar

• Law Society of Western Australia, and

• Western Australian Bar Association

The Law Council of Australia (LCA) represents these 16 State and Territory Law Societies and Bar Associations (the LCA Constituent Bodies) at the national and international level.(Home Page – Law Council of Australia)

“The secret of getting ahead is getting started.”