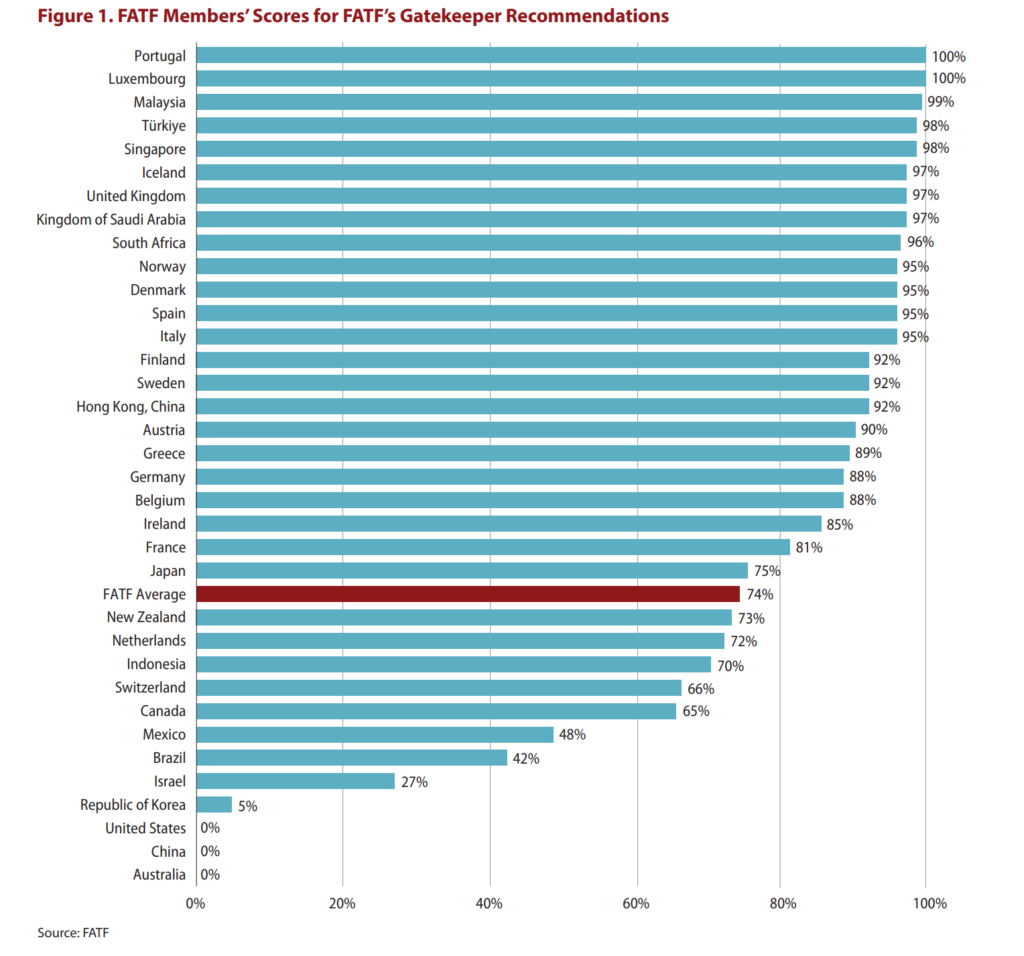

FATF - July2024

Technical Compliance Related to

Corruption

compliance to FATF's requirements

for the gatekeeper sector

compliance to FATF's requirements

for the gatekeeper sector

Why Tranche Two Entities need to be covered under Australia's AML/CTF regime ?

Australia is not compliant with global standards

The Financial Action Task Force (FATF) is the global financial crime watchdog and standard-setter. As a founding member of FATF, Australia recognises the important role that the FATF plays in ensuring that the global response to money laundering and terrorism financing is robust and remains appropriately adapted to risks. The FATF’s Standards are accepted and implemented globally and comprise:

- 40 recommendations that promote the effective implementation of legal, regulatory and operational measures, and

- 11 Immediate Outcomes that establish indicators of an effective regime.

There are a number of FATF Standards specific to tranche-two entities:

- Recommendation 28 requires countries to regulate and supervise tranche-two entities for AML/CTF purposes

- Recommendations 22 and 23 specify the application of other FATF Recommendations to tranche‑two entities such as customer due diligence, record-keeping, reporting suspicious transactions and internal control requirements

- Immediate Outcome 3 relates to the effectiveness of supervision measures for financial institutions and tranche-two entities, and

- Immediate Outcome 4 relates to the measures that financial institutions and tranche-two entities take in response to their understanding of money laundering and terrorism financing risks.

Tranche two entities

Accountants

The proposed reforms are intended to cover accountants when they prepare or carry out transactions for clients, relating to the following:

- buying and selling of real estate

- managing of client money, securities or other assets

- management of bank, savings or securities accounts

- organisation of contributions for the creation, operation or management of companies

- creation, operation or management of legal persons or legal arrangements (e.g. trusts), and

- buying and selling of business entities.

Legal practitioners

The proposed reforms are intended to cover legal practitioners when they prepare or carry out transactions for clients, relating to the following:

- buying and selling of real estate

- managing of client money, securities or other assets

- management of bank, savings or securities accounts

- organisation of contributions for the creation, operation or management of companies

- creation, operation or management of legal persons or legal arrangements (e.g. trusts), and

- buying and selling of business entities.

Trust and Company Service Providers

The proposed reforms are intended to cover Trust and Company Service Providers when they prepare or carry out transactions for clients, relating to the following:

- acting as a formation agent of legal persons

- acting as (or arranging for another person to act as) a director or secretary of a company, a partner of a partnership, or a similar position in relation to other legal persons

- providing a registered office, business address or accommodation, correspondence or administrative address for a company, a partnership or any other legal person or arrangement

- acting as (or arranging for another person to act as) a trustee of an express trust or performing the equivalent function for another form of legal arrangement, and

- acting as (or arranging for another person to act as) a nominee shareholder for another person.

Real Estate Sector

The proposed reforms are intended to cover Real Estate agents and property developers when they prepare or carry out transactions for clients, relating to the following:

- to buy or sell real estate, including any legal or equitable interest in real property, including freehold title, strata title or leasehold tenur

The considerations are in place to include property management and leasing services.

Dealers in precious metals and precious stones

The proposed reforms are intended to cover dealers in precious metals and stones

- any cash transaction with a customer equal to or above AUD10,000, including in the capacity of an agent or auctioneer.

Bullion dealers are already covered by the AML/CTF regime and will remain subject to the Act.

Financial Action Task Force, ‘RBA Guidance for dealers in precious metal and stones’, Publications (Web Page, June 2008) https://www.fatf-gafi.org/en/publications/Fatfrecommendations/Fatfguidanceontherisk-basedapproachfordealersinpreciousmetalsandstones.html.